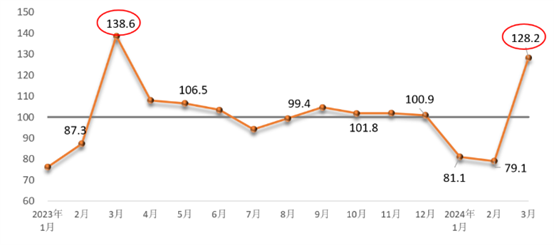

I. March Building Materials Industry Prosperity Index 2024 March Building Materials Industry Prosperity Index was 128.2 points, higher than the critical point, in the boom zone, than in February, a significant rebound, but the rebound is less than the same period last year. 1, February for the building materials market 'off-season', the building materials industry prosperity index fluctuated below the threshold in February by the Spring Festival holiday factors, there was a slight fall. January, February is the building materials market 'off-season', the building materials industry prosperity index in the critical point of fluctuations below, in February by the Spring Festival holiday factors, there is a slight decline. March with the climate, holidays and other seasonal factors, downstream construction, manufacturing market gradually start, building materials enterprises to speed up the resumption of production, the building materials industry prosperity index rebounded to the booming range.

Figure Construction Materials Industry Monthly Prosperity Index

On the supply side, in March, the price index of the construction materials industry was at the critical point, and the production index rebounded to the boom zone. Among them, the building materials industry price index 100.0 points, the same as last month; building materials industry production index 128.3 points, 48.5 points higher than last month. Overall, building materials product prices are still in the downward range, but in March showed signs of stabilization of the low; building materials production activity than in February significantly improved, promoting the building materials industry boom degree rebound. Demand side, building materials investment demand index, industrial consumption index, international trade index are higher than the critical point, back to the boom area. Among them, building materials investment demand index 129.7 points, 50.6 points higher than last month, higher than the critical point, the construction market gradually start, but compared to the same period last year, the start of the speed of the relatively slow; building materials products industrial consumption index 122.8 points, 40.3 points higher than last month, the application of building materials products related to the manufacturing industry demand for a smooth recovery; building materials international trade index 141.8 points, 73.3 points higher than last month, building materials commodities rebound 73.3 points, building materials commodity trade recovery faster. Overall, the building materials market gradually started in March, but the speed and extent of the start vary.

II. MPI influencing factors analysis and early warning

Building materials market changes show structural differences. With the issuance of additional trillions of treasury bonds in 2023 for key areas, key project construction and other growth stabilization policies, after the Spring Festival, many places to start construction projects, building market demand gradually start, but the speed of start-up is not as fast as the same period of the previous year, and is still dominated by the stock of projects, from January to February, the infrastructure investment increased by 6.3% year-on-year, lower than the same period of the previous year, 2.5 percentage points; automobiles, photovoltaic batteries, electrical and electronic appliances, Household appliances and other products production orderly recovery, but the output of major products from high-speed growth to steady growth, the incremental demand for related building materials products has declined; building materials end consumer market is more active, 1-2 months, above the limit of construction and decorative materials commodity sales increased by 2.1% year-on-year, since 2021 continued to decline since the growth again, effectively stabilizing the consumer market expectations. Product prices showed signs of stabilization at a low level. in March, in the building materials sub-industry, cement, bricks and building blocks, thermal insulation materials, construction stone, fiber-reinforced composite materials, building sanitary ceramics, non-metallic mineral extraction industry, such as 7 industry product prices rose; construction and technical glass, thermal insulation materials, lime gypsum and other products in 3 industries, ex-factory price year-on-year to maintain growth. However, the relationship between supply and demand in the building materials market is difficult to improve significantly, the rising price power is not enough. Building materials industry economic operation volatility risk increases. Recently, 12 high-risk debt provinces and municipalities were asked to slow down or stop building infrastructure projects, involving 12 provinces and municipalities in 2023 construction industry output value accounted for 15% of the country, will weaken the market expectations, and affect the regional market balance, resulting in increased cross-regional competition. According to monitoring information, some regions are relatively lagging behind in the availability of funds, affecting the progress of projects, and competition among enterprises will be further increased.